North Macedonia: Election Analysis

Outlook:

- Parliamentary elections were held on 15 July;

- Zoran Zaev’s SDSM-BESA coalition emerged as the largest single bloc by two seats but failed to secure an absolute majority;

- The high rate of abstention by Macedonian voters resulted in DUI and AA-Alternativa accruing historic gains at the expense of SDSM-BESA and VMRO-DPMNE, given that the Albanian constituency mobilized in normal numbers;

- DUI not only retains its status as kingmaker, but will have increased influence;

- A coalition government involving SDSM-BESA, DUI and DPA is the most likely scenario, with an Albanian prime minister emerging as a possibility.

- The institutional and business environment is likely to remain unchanged, albeit with greater government instability, as the ruling majority is likely to be no more than 1-2 seats in the most realistic scenarios.

1. Overview

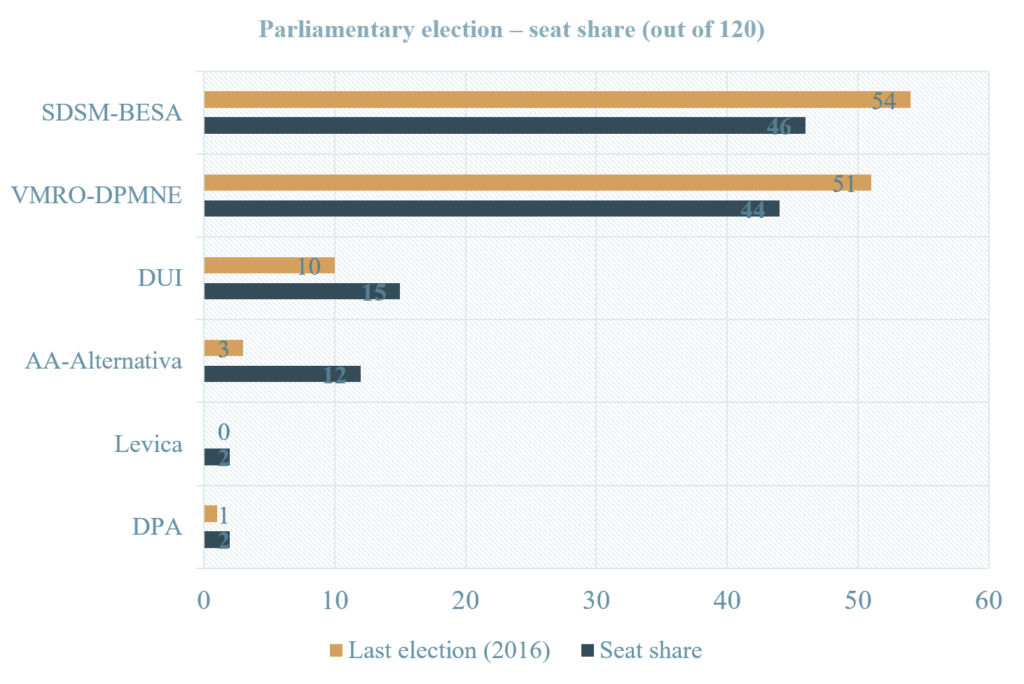

On 16 July, elections were held for the 120 seats comprising North Macedonia’s unicameral parliament. Voting was organised in line with extraordinary health measures, which had been imposed owing to the COVID-19 pandemic, the infection rate of which has experienced an upsurge over the past month. Turnout amounted to 51.3%, a historic low, and down from 66% in 2016. The conduct of the election was largely in line with international standards, despite some isolated irregularities. With 98.3% of ballots counted, the breakdown of seats between the party lists is as follows:

As predicted, the SDSM-BESA alliance, led by Zoran Zaev, emerged as the largest party, albeit without an absolute majority. However, both SDSM-BESA and Hristijan Mickoski’s VMRO-DPMNE scored 1-4 seats below the lowest share projected by a median range calculated from 12 reputable polls. Meanwhile, the Albanian parties DUI and AA-Alternativa outperformed projections, accruing 27 seats between them – in addition to the single seat won by the DPA. Historically, Albanian parties have never won more than 20 seats between them. The reason for this result is that Albanian voters mobilised in their usual numbers, as opposed to Macedonians, who abstained to a disproportionately high extent. Elsewhere, the populist far-left Levica performed strongly relative to its size, securing two seats. Integra, a small centre-right party that had hoped to win a single seat failed to do so. The Macedonian diaspora vote failed to reach the threshold for any of the additional three seats to be filled.

2. Outlook: Government formation

The election result is unprecedented because of the extent to which the Albanian bloc, polarised though it is, has increased its seat share in parliament. The negotiating leverage of DUI, in particular, is likely to increase significantly. In terms of the formation of a government, the two most likely scenarios are either:

- SDSM-BESA + DUI + DPA = 62 seats;

- VMRO-DPMNE + DUI + Levica = 61 seats;

The preference of SDSM-BESA would have been a coalition with AA-Alternativa, but together they are two seats short of an absolute majority. This leaves a coalition with DUI as the only viable option for SDSM-BESA, possibly also co-opting the single seat of the DPA in order to take the edge off such a razor-thin majority. A coalition including AA-Alternativa is virtually impossible, given that the party is in bitter opposition to DUI.

The only viable coalition that VMRO-DPMNE could form would need to include DUI, as well as Levica. Although Levica is strongly in favour of a multi-ethnic state, it is nonetheless left-wing nationalist. As such, VMRO-DPMNE is probably a more viable coalition partner, given that there are some shared policy positions and Levica has defined itself in opposition to SDSM-BESA.

A third scenario would involve the formation of a national unity government between SDSM-BESA and VMRO-DPMNE, in addition to other parties, to at least provide some stability amid the need to manage the COVID-19 pandemic. This would a last resort given that the election was held to secure legitimacy for a government with a political mandate.

We assess that the first scenario is more likely, as SDSM-BESA will have first dibs on forming a government. The kingmaking influence of DUI would also be larger under such a constellation, not least because the party’s votes would be sufficient to secure an absolute majority. However, negotiations will be difficult as the bitterness of the election campaign, combined with DUI’s relative success, will increase the party’s leverage. In order to secure the support of DUI, SDSM-BESA will need to agree to its demand that an Albanian prime minister be appointed, or otherwise offer a comparable concession. Unlike SDSM-BESA, VMRO-DPMNE would almost definitely be unwilling to accept such a demand, likely calculating that in positioning itself in opposition to an Albanian-led government with a thin majority, it will be able to consolidate much of the Macedonian vote. The centres of power would remain virtually identical to those of the previous coalition, albeit with SDSM weakened while DUI enjoy increased influence. Moreover, there is a significant likelihood that Zaev will not return as prime minister and instead continue to exert his influence from the SDSM party leadership.

The negotiation of a new ruling majority is likely to take weeks, if not months. However, the contours of negotiations and likely scenarios will become clearer after the weekend of 17-19 July, after which the State Election Commission will have completed the final count of the votes.

3. Outlook: Government stability

Government instability is likely to increase in the 1-year outlook regardless of which scenario transpires. The working majority of either coalition government will be very thin, amounting to 1-2 votes. An SDSM-BESA/DUI coalition could potentially rely on the support of AA-Alternativa or Levica on a case-by-case basis; however, the conditions for such cooperation would be high, as it is in the interest of neither party. There is a considerable likelihood that the government will collapse with the possibility of snap elections being held in the 1-2 year outlook.

The institutional environment is unlikely to change, with any improvements to the rule of law being selective, especially with respect to corruption cases concerning DUI officials. In light of government instability and the depressed economic environment, the ruling parties will likely want to accumulate any policy successes they can.